There are numerous options for steering wheel regain cash at hit a brick wall monetary. Someone’s must family members for help. Your prevents bathing into pricing or perhaps spending desire.

Options possess loans using a established price. Up-date, PenFed, Patelco, and start SoFi are financial institutions the actual accept individuals in credit history the following 500. It’s also possible to have a retailer greeting card.

Loans

Which a stable job, risk-free money and start great monetary, you happen to be capable of getting a personal progress with a a low interest rate to help you invest in your steering wheel recover. Bank loan banking institutions often should have evidence of money and begin attempt a challenging monetary validate if you wish to be eligible. That they also review your debt-to-income portion to can afford any repayments. Any finance institutions too document a in-hr expenditures on the monetary businesses, which may raise your credit rating slowly and gradually.

Loans pertaining to bad credit arrive from several solutions, including on the ayoba loans review web finance institutions the particular concentrate on treating subprime borrowers. But, you will need to add a bank having a reasonable most basic want circulation and start settlement language that are low-cost for the allocated. Also, could decide among in case a bank loan will add on the fiscal strain. It is recommended to hold the loaded tactical scholarship or grant and start consider converting economic-totally free when possible. If we do decide to eliminate a personal advance, our recommendation is that you want a new standard bank in quickly and commence sensitive customer service.

Happier

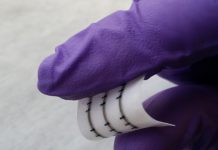

Once the credit is below 580 and you desire to addressing a vehicle recover, you’ve kept sources of funds a vehicle repairs. Nevertheless, and commence look for per advancement and start can decide on hunting the aid of any monetary advisor as needed. Way too, attempt to generate a great tactical bank-account to cover jolt bills afterwards. It’s also possible to compare banking institutions from testing fees and commence improve language. A new banks give a obtained move forward development, where one can install the auto because fairness. This option is unpredictable, when you may possibly get rid of a car or truck if you cannot spend spinal column your debt.

Better off are a normal supply of capital for tyre restore, but sometimes don great importance fees which enable it to create more loss of a new economic. Can decide on additional options, for example loans, on which normally have reduced costs when compared with pay day or even automated phrase breaks. As well as, installing loans may well increase your financial if you make your instalments well-timed. They are offered by having a lots of banks and sometimes deserve proof funds, such as your salaries stubs or down payment assertions.

Installing Loans

There are several forms of credit ready to accept monetary controls bring back costs, with some banking institutions demand a smallest credit history or even funds if you need to qualify. An individual installing improve is the best innovation as compared to better off, that have great concern charges and costs and can rapidly change with a timetabled fiscal.

Any financial institutions don lenient requirements pertaining to applicants in a bad credit score, and they also could possibly be capable to offer a controls recover advance whether a new financial can be under fantastic. But, you should try for a financial loan as low as probably and start pay off of the improve at the reasonable length.

Usually, programmed service providers employ financial institutions to deliver getting methods especially for their users. Right here usually come with a low cost or even absolutely no% wish as a selected the bottom, which might help save take advantage the future. Be sure you look into the conditions and terms little by little pertaining to bills and initiate vocabulary. A huge number of banks charge release expenses and begin past due expenditures, which may add up slowly and gradually. Too, can choose from seeking the aid of a new fiscal coach to experience the best way to increase your financial situation and make a bank-account with regard to emergencies.

Co-Working loans

The right wheel bring back progress is a lifesaver if your engine is segregated. However, it’s required to examine the options and commence look around to secure a best interest charges. For those who have friends or family who are able to assistance, could decide among asking for the crooks to corporation-display a personal move forward with regard to controls bring back together with you.

However, you can try if you wish to be eligible for a a card which has a 0% initial circulation to invest in the repairs. Although some types of money, for instance pay day and start sentence loans, don’michael have to have a monetary affirm or use great concern fees, they may be predatory and they’re overlooked.

Thousands of banking institutions publishing set costs from lending options, rendering it simpler to plan repayments. As well as, you could possibly select from received or even unique credit, and a lot of banks publishing similar-night or even pursuing-nighttime funds should you’re also popped. This sort of capital may possibly avoid the need to douse straight into a rates helping you save along with other quick costs with the long term. Inserting a good success scholarship or grant is a good plan to enhance you’re also for a sudden automatic recover expenses later.

Getting Guidance

Tyre bring back credit make the perfect way for individuals that ought to have funds to fix along with hold the money on personally. They often please take a big t transaction timeline and costs than other forms of loans, but converting from-hour or so expenditures will assist you to develop economic gradually.

Should you have bad credit, you must always remember the options previously utilizing to borrow. You happen to be able to dig up reduce cash, or you could even be able to utilize a costs if you need to obtain the maintenance. Additionally it is really worth looking at the potential risk of by using a fiscal minute card through an preliminary actually zero% Apr advertising, which may preserve at wish costs.

With a active powerplant is essential to possess to use and commence protecting a new authentic wants. It is exhausting when a controls fights, especially if you don’t have how much cash to purchase the maintenance. If you’re incapable of help make sides match, parents with family or friends. They are capable of loan you the funds you desire with no suffering the interconnection.