Imagine that you’re in the mall for those last minute Christmas gifts. There are people all around you, bumping into you and hustling around trying to get that last r.c. car. You get your hands on the last R.C. car, and then when you go to pay with your EMV Credit Card, it get’s declined? Wait what? You just payed your credit card balance to 0, how did this happen?

Well you may just have been hacked. 25 billion dollars a year are lost this way by just Americans. In the United States we have been switching over to the EMV credit cards. Shouldn’t that make using these cards safer? Although these chip and pin cards, also called EMV’s, are safer than your regular magnetic stripe credit card, they are not foolproof.

Let’s learn about how these cards work to see why. The EMV credit card was used as a standard in Europe for quite a long time now. In the United States, the chip and pin system is only just starting to be seen. Before the EMV system, we had a plain magnetic stripe and signature. In fact, many of us still have this type of credit card.

With the magnetic strip card, someone with an RFID reader, or maybe a skimmer on an ATM machine or credit card reader could essentially take your information extremely easily. The RFID reader can take your information just by walking near you. A skimmer is just a device they place on ATM cards to read your card number and steal.

So to prevent skimming, they decided to use the EMV credit card card. This system makes it hard to skimmers to get a card, since they have to figure out the pin. Now this sounds great in theory, but not so fast. In the United states, we don’t have to actually put a pin in for most credit card readers. This means that if they just ask for a signature, this will actually have zero effect against skimmers. I know, I know, then how in the world do you stay safe!

Here are a couple of ways to defend yourself against these situations:

#1: The very first step is to stick to credit cards, and rely less on debit cards. The reason is simple. If your credit card gets hacked and used, you can complain to the credit card company and they will take care of it. On the other hand, if a debit card is stolen and used, all the money in that related checking account can be taken, and it’s harder to get a claim to get that money back. My rule is simple, never have more money in a checking account connected to a debit card than you can afford to lose!

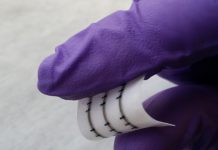

#2: Get an RFID blocker. Although these only protect against rfid readers, and skimmers can still get your info, at least that’s one thing you don’t have to worry about.

*pro tip* If appearance doesn’t bother you, a card wrapped in aluminum foil does the trick just as well as most RFID blockers.

As long as you follow these safety rules, you can minimize and type of credit card information being stolen!